More Medical Bankruptcy-Have Insurance, Go Bankrupt - PNHP Press Release

Press Release:

Medical problems contributed to nearly two-thirds (62.1 percent) of all bankruptcies in 2007, according to a study in the August issue of the American Journal of Medicine that was published today online. The data were collected prior to the current economic downturn and hence likely understate the current burden of financial suffering. Between 2001 and 2007, the proportion of all bankruptcies attributable to medical problems rose by 49.6 percent. The authors’ previous 2001 findings have been widely cited by policy leaders, including President Obama.

Surprisingly, most of those bankrupted by medical problems had health insurance. More than three-quarters (77.9 percent) were insured at the start of the bankrupting illness, including 60.3 percent who had private coverage. Most of the medically bankrupt were solidly middle class before financial disaster hit. Two-thirds were homeowners and three-fifths had gone to college. In many cases, high medical bills coincided with a loss of income as illness forced breadwinners to lose time from work. Often illness led to job loss, and with it the loss of health insurance.

Even apparently well-insured families often faced high out-of-pocket medical costs for co-payments, deductibles and uncovered services. Medically bankrupt families with private insurance reported medical bills that averaged $17,749 vs. $26,971 for the uninsured. High costs – averaging $22,568 – were incurred by those who initially had private coverage but lost it in the course of their illness.

Individuals with diabetes and those with neurological disorders such as multiple sclerosis had the highest costs, an average of $26,971 and $34,167 respectively. Hospital bills were the largest single expense for about half of all medically bankrupt families; prescription drugs were the largest expense for 18.6 percent.

The research, carried out jointly by researchers at Harvard Law School, Harvard Medical School and Ohio University, is the first nationwide study on medical causes of bankruptcy. The researchers surveyed a random sample of 2,314 bankruptcy filers during early 2007 and examined their bankruptcy court records. In addition, they conducted extensive telephone interviews with 1,032 of these bankruptcy filers.

Their 2001 study, which was published in 2005, surveyed debtors in only five states. In the current study, findings for those five states closely mirrored the national trends.

Subsequent to the 2001 study, Congress made it harder to file for bankruptcy, causing a sharp drop in filings. However, personal bankruptcy filings have soared as the economy has soured and are now back to the 2001 level of about 1.5 million annually.

Dr. David Himmelstein, the lead author of the study and an associate professor of medicine at Harvard, commented: "Our findings are frightening. Unless you’re Warren Buffett, your family is just one serious illness away from bankruptcy. For middle-class Americans, health insurance offers little protection. Most of us have policies with so many loopholes, co-payments and deductibles that illness can put you in the poorhouse. And even the best job-based health insurance often vanishes when prolonged illness causes job loss – precisely when families need it most. Private health insurance is a defective product, akin to an umbrella that melts in the rain."

"For many families, bankruptcy is a deeply shameful experience." noted Elizabeth Warren, Leo Gottlieb Professor of Law at Harvard and a study co-author. Professor Warren, a leading expert on personal bankruptcy, went on: "People arrive at the bankruptcy courts exhausted—financially, physically and emotionally. For most, bankruptcy is a last choice to deal with unmanageable circumstances."

According to study co-author Dr. Steffie Woolhandler, an associate professor of medicine at Harvard and primary care physician in Cambridge, MA: "We need to rethink health reform. Covering the uninsured isn’t enough. Reform also needs to help families who already have insurance by upgrading their coverage and assuring that they never lose it. Only single-payer national health insurance can make universal, comprehensive coverage affordable by saving the hundreds of billions we now waste on insurance overhead and bureaucracy. Unfortunately, Washington politicians seem ready to cave in to insurance firms and keep them and their counterfeit coverage at the core of our system. Reforms that expand phony insurance - stripped-down plans riddled with co-payments, deductibles and exclusions – won’t stem the rising tide of medical bankruptcy."

Dr. Deborah Thorne, associate professor of sociology at Ohio University and study co-author stated: "American families are confronting a panoply of social forces that make it terribly difficult to maintain financial stability—job losses and wages that have not kept pace with the cost of living, exploitation from the various lending industries, and, probably most consequential and disgraceful, a health care system that is so dysfunctional that even the most mundane illness or injury can result in bankruptcy. Families who file medical bankruptcies are overwhelmingly hard-working, middle class families who have played by the rules of our economic system, and they deserve nothing less than affordable health care."

"Medical bankruptcy in the United States, 2007: Results of a national study," David U. Himmelstein, M.D; Deborah Thorne, Ph.D.; Elizabeth Warren, J.D.; Steffie Woolhandler, M.D., M.P.H. American Journal of Medicine, June 4, 2009

-----------------------------------------------------------------------------------------

Medical Bankruptcy – Q&A

1 - What is a "medical bankruptcy"?

A number of medical factors can contribute to a family’s financial collapse, including high medical bills or lost time from work. Because different researchers use different definitions, we supplied a detailed analysis of debtors who:

• Specifically identified medical problem of the debtor or spouse (32.1%) or another family member (10.8%) as a reason for filing bankruptcy.

• Specifically said medical bills were a reason for bankruptcy. (29.0%)

• Lost two or more weeks of wages because of lost time from work to deal with a medical problem for themselves or a family member. (40.3%)

• Mortgaged their homes to pay medical bills. (5.7%)

• Spent more than $5,000 or 10% of annual household income in out-of-pocket medical bills (34.7%)

• Total, one or more of the above criteria: 62.1%

The vast majority (92%) of bankruptcies that we classified as medical had medical bill problems as indicated by: listing medical bills as a specific reason for their bankruptcy; or having medical bills of bills $5,000 or 10% of household income or that forced them to mortgage their home. The remaining 8% whose bankruptcy was classified as "medical" indicated that a medical problem or income loss due to illness was a cause of bankruptcy.

2 - Why do only 29% of bankrupt people identify medical bills as a reason for filing bankruptcy, but you say the total percentage of medical bankruptcies is 62.1%?

Families characterize their problems differently. Someone may mortgage a home to pay for surgery, then be unable to pay off the mortgage, describing the reason for filing bankruptcy as "unable to pay the mortgage." Similarly, some people explain that they have lost too much time from work when they have taken off to care for a child who has been hospitalized. We believe that multiple ways of asking about medical bankruptcies give the most complete picture, but we publish the breakdown in responses so that any other research or commentator can draw his or her own conclusions.

Finally, it should be noted that many people who are financially ruined by illness are undoubtedly too ill, too poor or demoralized to pursue formal bankruptcy, and are not counted in our study.

3 - What is the impact of health insurance?

More than three-quarters (78%) of the families that met the criteria for medical bankruptcy had health insurance at the onset of their illness or accident. By comparison, 80% of the non-elderly adult population and 85% of the entire U.S. population had health insurance in 2007. Hence, it appears that health insurance offers only modest protection against medical bankruptcy.

4 - Is the problem of medical bankruptcies just because of the recession?

No. The families in this study filed for bankruptcy between January-April of 2007, before the recession began. Since then, the financial stress on families has grown.

5 - Is this a national sample of all families filing for bankruptcy?

Yes. The sample was drawn from bankruptcy filings across the country.

6 - How did you get your information?

We contacted a random sample of all personal bankruptcy filers in the U.S. during the winter of 2007. Written questionnaires were returned by 2,314 debtors, and we also analyzed their bankruptcy court records. We also carried out extensive telephone interviews with 1,032 of these debtors.

Finally, to be sure that the debtors who returned our survey were similar to those who did not, we also analyzed the court records of 99 of the non-respondents. They were almost identical to those who returned the survey in terms of debts, income, assets and other characteristics.

7 - What’s the basis for saying that the proportion of bankruptcies that are medical rose by 50% between 2001 and 2007?

In order to compare the medical bankruptcy rates in 2007 and in our 2001 study we had to use the same definitions in both years. Our 2001 study had used a less stringent ("legacy") definition of medical bankruptcy that included families with more than $1000 in unpaid medical bills. Using this "legacy" definition, the medical bankruptcy rate rose from 46.2% in 2001 to 69.1% in 2007 – a 49.6% increase. The 2001 estimate relied on data collected from bankruptcy filers in five states. Analysis of the 2007 data confirmed that the five states included in the 2001 survey also saw a 50% increase in medical bankruptcies.

8 - Would health reform eliminate the problem of medical bankruptcy?

Many debtors described a complex web of problems involving illness, work, and family. Separating medical from other causes of bankruptcy is difficult. Hence, we cannot presume that eliminating the medical antecedents of bankruptcy would have prevented all of the filings we classified as "medical bankruptcies." The high rate of insurance among the medical bankrupts suggests that any health reform that fails to improve existing private coverage is unlikely to make a major impact on medical bankruptcy. Moreover, our data also highlight the need for improved disability coverage.

9 - Why do some others claim that medical bankruptcy rates are much lower?

Ours is the only study based on direct surveys and interviews with a large sample of families filing for bankruptcy. Others have based their findings on bankruptcy court records alone (with no direct surveys or interviews) or on surveys of the general public that inquire about bankruptcy filings. Court records fail to identify medical bankruptcies because many medical bills are charged to credit cards and hence cannot be identified as "medical" in court records. Similarly, when medical providers turn debts over to collection agencies they would not appear as "medical." Because bankruptcy carries a substantial stigma, about half of all respondents who are bankrupt deny that fact. As a result, surveys of the general public are an unreliable source of information on medical bankruptcy. For these reasons, the only way to accurately assess medical bankruptcy is to directly survey families who file for bankruptcy.

-------------------------------------------------------------------------------------------------

Medical Bankruptcy – Fact Sheet

• In May 2009, more than 5,000 families filed for bankruptcy every business day. For all of 2009, the total is expected to reach about 1.4 million. The average personal bankruptcy involves 2.71 debtors and dependents. In total, an estimated 3.8 million Americans will be involved in personal bankruptcy filings this year.

• Illness and medical bills were a cause of at least 62.1% of all personal bankruptcies in 2007. Based on the current bankruptcy filing rate, medical bankruptcies will total 866,000 and involve 2.346 million Americans this year – about one person every 15 seconds.

• Using identical definitions in both years, the proportion of bankruptcies attributable to medical problems rose by 49.6% between 2001 and 2007.

• Most medically bankrupt families were middle class before they suffered financial setbacks. 60.3% of them had attended college and 66.4% had owned a home; 20% of families included a military veteran or active-duty soldier.

• Most medical debtors had some health insurance, but many suffered gaps in coverage:

77.9% of the individuals whose illness led to bankruptcy had health insurance at the onset of the bankrupting illness; 60.3% had private insurance.

69% of debtor families had coverage at the time of their bankruptcy filing

60% of families had continuous coverage

Only 0.3% of the uninsured went without coverage voluntarily, i.e. because they though they didn’t need it – most others couldn’t afford it.

• Among medical debtors, hospital bills were the largest medical expense for 48% drug costs for 19%, doctors’ bills for 15% and insurance premiums for 4%. In 38% of cases, lost income due to illness was a factor.

• Out-of-pocket medical costs since the onset of illness averaged $17,943.

- For the privately-insured, out-of-pocket costs averaged $17,749.

- For the uninsured, out-of-pocket costs averaged $26,971.

- Patients with neurologic disorders such as multiple sclerosis faced the highest costs, and average of $34,167, followed by diabetics at $26,971.

• According to earlier studies, between 7.1% and 14.3% of Canadian bankruptcies are due to "health/misfortune" (a category that includes some non-medical problems).

--------------------------------------------------------------------------------------------------------

Downloadable copies of press release and info above is at the PNHP website here.

And again, downloadable full text of professional peer review journal article is here.

----------------------------------------------------------------------------------------------------------

More:

In addition to whatever else your minimal demand is, mine is for what would seem to be a non-radical, non-shrill, non-extremist minimal demand, and one that some senators and congresscritters claim to have agreed to (but need pressure to help them keep them promise):

"There must be a complete, honest, side-by-side comparison of all proposals, including single payer HR-676 (Conyers) and SB-703 (Sanders), by the Congressional Budget Office.

The side-by-side comparison should include projected costs to state governments, employers and to households of different income levels. For 2010 and beyond."

It is crticial that whatever it is we are going to be allowed to get, and whatever it is we are not getting, be honestly and transparently compared for all to see:

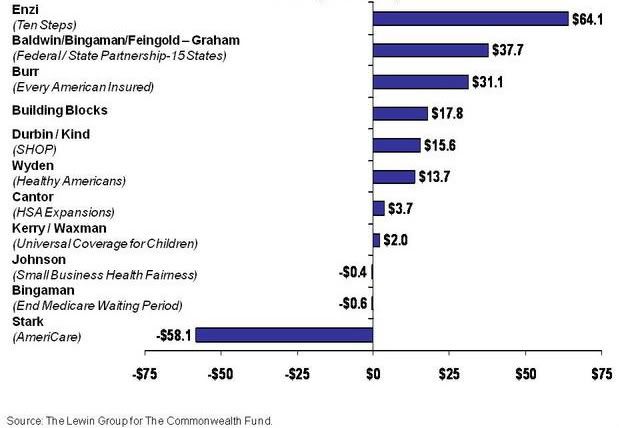

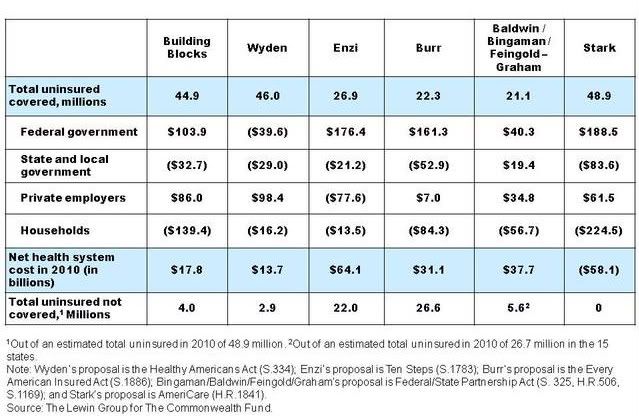

The best we have for now is the January 2009 report from the Commonwealth Fund done by the Lewin Group comparing congressional proposals, as summarized in their graph and table below:

- "Stark"=Single Payer (expanded and improved Medicare for All)

- "Building Blocks" = Obama/Baucus (mandates to buy private for-profit health insurance + real Public Option + expanded Medicaid)

Total Change in National Health Expenditures, in 2010 (in Billions) Under Different Health Reform Proposals:

and

Change in Health Spending by Stakeholder Group, Billions of Dollars, 2010

That is why Senator Baucus keeps asking the CBO to "fix the numbers."

Call these critical Democratic Senators, and let your voice be heard:

- Senator Max Baucus at (202) 224-2651

- Senator Charles Schumer at 202-224-6542

- Senator Edward Kennedy at (202) 224-4543

- Senator John Rockefeller at (202) 224-6472

- Senator Ron Wyden at (202) 224-5244

- Senator Kent Conrad at (202) 224-2043

- Senator Jeff Bingaman at (202) 224-5521

- Senator John Kerry at (202) 224-2742

- Senator Blanche Lincoln at 202-224-4843

- Senator Debbie Stabenow at (202) 224-4822

- Senator Maria Cantwell at 202-224-3441

- Senator Bill Nelson at 202-224-5274

- Senator Robert Menendez at 202-224-4744

- Senator Thomas Carper at (202) 224-2441

Cross Posted from Daily Kos with a Hat Tip to Dr. Steve

No comments:

Post a Comment